“Short Sales” are very common in our Phoenix market right now, so make sure you understand the process before making any decisions, because they can be extremely challenging and frustrating to deal with if you’re not familiar with the process…

Actually, even if you ARE familiar with the process, they’re still challenging to deal with!

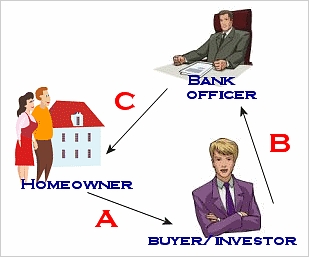

A “short sale” is when the seller owes more on their mortgage than they can clear when they sell their house, so they must get the bank to approve the “shortage” of funds to pay off the loan and release the mortgage lien on the property.

A successful short sale typically takes around 4-6 months to get an answer from the bank, and then you’ll have another 30 days to close after you get an approval from the bank. The key word being “successful,” because lots of short sale contracts just end up in limbo and you’ll never get any response from the bank at all…you’ll just find out some day that the bank went ahead and foreclosed on the property, or the seller filed bankruptcy, or any number of other problems. Only about 40%-50% of short sale contracts actually close escrow.

There are several pieces that must come together for a successful short sale.

The Seller: The seller still has title to the property, so they are first in line to approve any offers that come in. If the seller approves the offer, it is then forwarded to the bank for approval. If the house is an investment or a second home, the owner could have tax liability for the amount of loan forgiveness – the IRS could consider it income. If it is a primary residence, they can have loan forgiveness for the amount of the original loan on the property (known as original “purchase money”) without tax consequences, but not on any “cash out” refinancing loans or equity loans they may have borrowed since their original purchase.

The bank also needs to approve the financial hardship of the seller. If the seller does not have a legitimate financial hardship making it impossible for them to repay the loan, either through regular payments, or through other assets or bank accounts, the bank will deny the short sale and demand payment from the seller. For example, if the seller has savings, 401K plans or stocks that have enough value to cover some or all of the difference between the loan amount and the sale proceeds, the bank might require the seller to liquidate their accounts and pay off the loan. In that case, the seller might decide they are better off allowing the house to move to foreclosure.

“As Is” – you will be taking the property “as is” because the owner will not have any money to fix or repair anything, and the bank will not approve funds to do it. You will have a chance to have the property professionally inspected and can cancel if they find something you are unwilling to accept. Also, keep in mind that the seller is losing their house, almost like a foreclosure, so they are not motivated to maintain the property like a seller in a regular sale.

The Property Value: There are lots of stories around about buyers picking up $500,000 homes for $150,000, but most of those are just stories. The bank will have the property appraised by 3 different agents to get an opinion of value, called “Broker Price Opinions”. If they determine that based on the BPOs the offered price is too low, they will come back with a counter-offer that states the price they want for the house. More often than not, this is more than the “short sale” buyer is willing to pay. Banks use some formula, known only to them, to evaluate if it’s more beneficial for them to accept a short sale or move forward with a foreclosure. Any active Realtor can tell you about a foreclosure property that got listed at a lower price than the offer price they submitted for a buyer while it was still listed as a short sale.

Other Offers: During the 4-6 months the bank is reviewing your file, they will have the listing agent continue to actively market the property and take backup offers. If at the time they are ready to make a decision other offers have come in that are higher than yours, you could just be out of luck, as they can decide to accept the highest offer.

No Communication: Short sales are very frustrating to deal with because you do not hear ANY news or updates from the bank until they are ready to make a decision. Each Loss Mitigation Officer has an average of 300-500 files on their desk, so you are just a “file” to them. You could go for 4-5 months and never hear a single thing from the bank. Some banks actually have messages on their voice mails that say something along the lines of ”do not leave multiple messages, we’ll call you when we’re ready to call you.”

You’ll need to be patient. It’s sort of like throwing your offer into a black hole and hope it comes out the other side in 4-6 months. If you’re lucky you’ll get a house, and if you’re not, you’ll just have to move on to another property or wait for the house to come back on the market as a foreclosure.

Some buyers have asked if they can put deadlines in their offers to try to light a fire under the bank and create a sense of urgency. The answer is NO! If you put a deadline in your offer, and the deadline comes and goes before the file reaches the Loss Mitigation Officer’s desk, they’ll consider your offer expired and discard it. NEVER put a deadline in your offer when dealing with short sales!

On the good side:

- You usually don’t have to put up any earnest money whatsoever during the time you are waiting to hear from the bank. If the bank approves the sale, you will then deposit earnest money and all of the time periods for inspections, etc., will begin from the date of approval from the bank.

- You are free to continue looking for other properties and can withdraw your offer on the short sale at any time before getting acceptance from the bank, without any consequences to you whatsoever.

- Your “due diligence” and inspection times do not start until you have an acceptance from the bank, so you don’t have to invest any money for inspections, appraisals, etc., until you know for sure you have a deal.

- Although the house might have deferred maintenance items, it usually won’t be trashed like many foreclosure properties are.

- A competent and experienced agent can help get your offer through the short sale hoops and increase the chances of a timely and positive response from the bank.

- If your contract goes through on a short sale, you could end up with a REALLY good deal.

Buying a home is always exciting, and we at www.GolfAt55.com can help you find great deals on regular sales, short sales or foreclosures. Our expert advice and guidance is always free to the buyer, so go ahead and take advantage of us…we love what we do and you’ll love working with us!